- SOLUTIONS

Streamline Document Workflows with AI

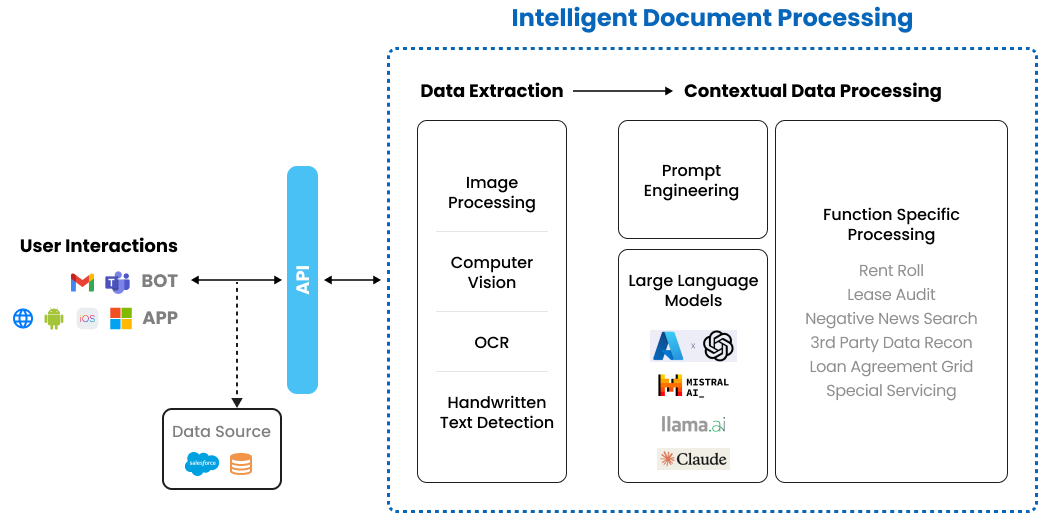

Transform your asset-backed underwriting operations without investing in additional human capital. Automate extraction of critical information from various formats, seamlessly integrating with existing workflows. Empower your team's business intelligence to focus on high-value tasks so that makers become checkers. Boost accuracy, accelerate decisions, and scale your business efficiently with seamless document processing.

- Key Solutions

Our platform delivers best-in-class intelligent document processing specifically designed for asset-backed underwriting across multiple industries.

Our AI-driven document processing solution accelerates extraction, comparison, and validation across multiple document sources, integrating smoothly with your current underwriting systems while maintaining human oversight and operational excellence.

Key Benefits

Human-in-the-Loop

Our solution doesn’t replace people, it enhances them. We eliminate the manual tasks of data entry & document analysis and transform teams from manual processors into strategic analysts.

Multi document comparison

Compare content between multiple document formats for efficient underwriting data analysis including images, text, and even handwriting.

Format agnostic document processing

Perform multi-document data validation across document types and formats, regardless of content, including text, image, and handwriting, without additional setup.

Flexible Architecture

Adapt to various document types, underwriting workflows, and user requirements with scalable solutions in your existing systems.

AI powered processing engine

Enhance document processing with AI-driven insights for enhanced industry intelligence, faster data analysis, and boosted underwriting workflows.

Seamless workflow integration

Seamlessly integrate Perfecter NOW™ into your existing underwriting workflows without extensive upgrades or manual setup.

Our platform is designed for seamless implementation, robust security, and compatibility with existing document-processing infrastructure.

We empower your team to make faster, more informed decisions while providing tangible ROI through increased productivity and reduced error rates. We transform document-heavy underwriting workflows into streamlined processes that support your broader digital transformation & business intelligence goals.

- Our Solutions

Real Estate Management

With the Perfecter NOW™ (Neural Optimized Workflows) platform, real estate financing companies can reduce the time to close and boost servicing productivity in areas like asset-backed underwriting. Unlike current OCR solutions, our framework delivers reliable results with minimal or no training.

The Perfecter NOW™ platform is accessible through Microsoft Teams, email, or app. It offers modular and highly customizable solutions, including connecting to CRMs, databases, or other data sources, making it ideal for real estate financing applications.

Title Due Diligence Search Reports

Ensure smooth and secure real estate transactions by instantly scanning records, identify liens, assessing ownership histories, and detect potential legal issues.

Rent Roll

Automate data entry, analyze payment trends, predict rent collection patterns, and optimize lease renewals by streamlining tenant communications for more efficient property management to help you make more informed decisions.

Multi Document Data Validation

Our AI-powered service simplifies data reconciliation across multiple sources by automating comparison and validation. This ensures accuracy, reduces manual errors, and speeds up the reconciliation process.

Financial Statement Analysis

We enable you to efficiently process financial data by automatically extracting and reviewing the accuracy of submitted data from any uploaded documents. This speeds up workflows and allows you to focus on business-critical tasks.

- Our Solutions

Finance, Insurance & Banking

Transform your document-intensive underwriting operations without expanding resources and costs. With our AI document processing platform, you can automate the extraction of critical financial information from various formats, enhance business intelligence with predictive insights, and empower your team to focus on high-value tasks, instead of data entry.

Corporate Credit Card Reconciliation

Automate data entry, expense validation workflows, correlation across invoices and purchase orders. This supports seamless integration with procurement processing workflows and ERP systems.

Call Quality Audits

Seamless validation of call recordings against success criteria that define calling efficacy for the business. We enable a custom validation process that helps businesses create checklists on the fly against which calls are assessed. This is enabled by automated extraction of call transcripts and validation against the success criteria, backed by evidence from the call recordings.

Key Use Cases

- Lease Analysis

- Rent Roll Analysis and Reconciliation

- Multi Document Data Validation

- Transfer Financials to Special Servicing Models

- Loan Application Analysis

- Title Due Diligence Search Reports

- Corporate Credit Card Reconciliation

- Call Quality Audits for Call Centers

- Contact Us